What really happened at Silicon Valley Bank? Why did a bank with more than $15 billion dollars in equity collapse from a loss of $1.8 billion dollars?

Banking woes at Silicon Valley Bank (SVB) have been widely covered. However, nothing has explained why a $1.8 billion dollar loss led to the collapse of a bank with $209 billion of assets and $15 billion dollars of equity. A $1.8 billion dollar loss alone would not cause this outcome. But, what really happened at Silicon Valley Bank?

Reported so far

As Silicon Valley Bank’s depositors faced rising interest rates, they began more heavily utilizing the deposits that they held at Silicon Valley Bank rather than borrowing as much money. As a result, SVB needed to raise cash to return money to their depositors. Many of the received deposits were invested in mortgage-backed securities (MBSs). SVB sold $21 billion dollars of securities, so that they could return depositor funds.

Since interest rates had risen since they purchased these securities, the securities were worth less at the time of sale. From this they incurred a loss of $1.8 billion dollars.

There is more to the story than has to come out

A loss of $1.8 billion would not be expected to wipe out equity of over $15 billion that SVB reported at the end of 2022. A sale of $21 billion in securities does not eliminate liquidity when SVB reported $108 billion in securities as of the end of 2022.

Significant undisclosed losses since the end of 2022 may explain the issue or part of it. Alternatively, the bank or regulators may know that far more withdrawals than have been processed may be underway. And that the return of these deposits will either consume the liquid capital of SVB or create losses beyond their available equity.

For now, just know that under either scenario more negative news will unfold before this story is finished.

Could reserve requirements have prevented this collapse?

Reserve requirements were eliminated in March of 2020. This made some sense when trying to stimulate the economy after the coronavirus. It made no sense, once the Fed began tightening. Additionally, it increased bank risk as we warned in: Reserve Requirement Abolished! What Is the Fed Doing Now?

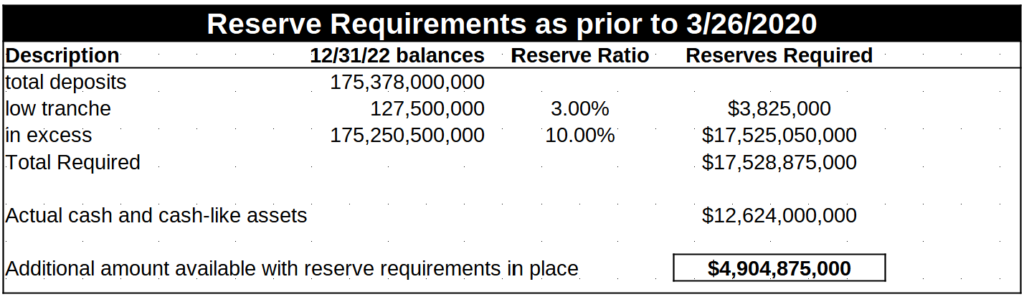

Would reinstating the reserve requirements have prevented the collapse of SVB? Consider two facts. First, SVB had $12,624,000,000 in cash and cash-like assets as of the end of 2022. This would have been illegal under the reserve requirement rules in place prior to March 26, 2020. They would have been required to maintain at least $17,528,875,000.

Second, SVB would have been holding an additional $4,904,875,000 in cash-like assets if the reserve requirements were unchanged. These additional funds would have provided significant additional capacity for the bank to meet their obligations. Would this have saved them? Not enough information is available yet to know for sure, but $5 billion of extra cash would have made SVB a lot more resilient.

See our most recent article regarding the bank failures.

Mind blown? If you learned something or found it interesting, you can easily share: