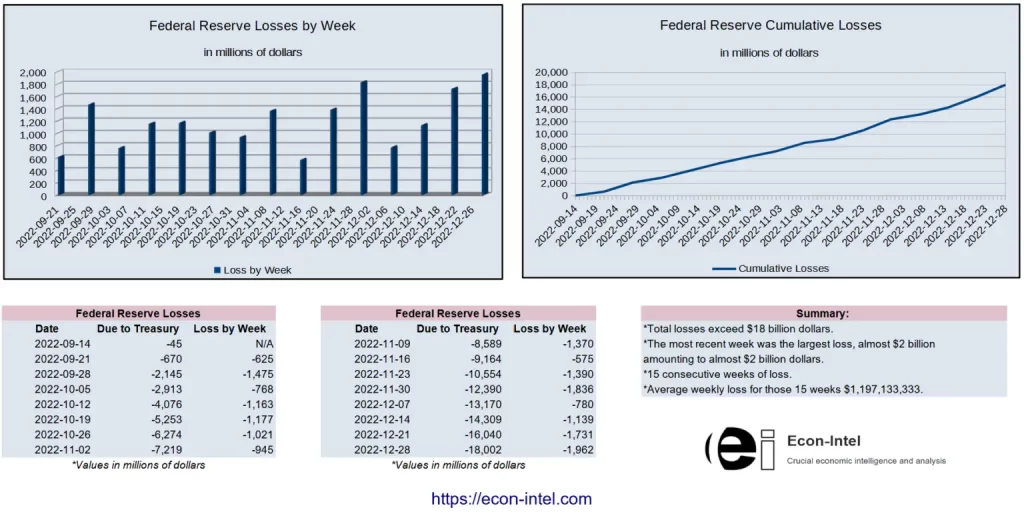

Concerned about the economy? Perhaps you should be. Now even the Federal Reserve (Fed) is losing money. Recently, the Fed began losing money. As of this writing, the Federal Reserve balance sheet indicates it has incurred losses for the last 15 weeks in a row. Fed losses now exceed $18 billion. This is a highly unusual situation. Why does it matter and what does it really mean?

Many concerning questions may come to mind when you hear that the Fed is losing money. Is the Federal Reserve out of money? Will they run out? Can the Federal Reserve go bankrupt? Will they become insolvent? This article will explain which of these questions doesn’t need to keep you up at night. As well as where there are real risks that you are better off knowing about.

Will Fed Losses Cause the Fed to Go Bankrupt?

The Federal Reserve can create money at will. So no, it will not go bankrupt and be unable to meet its obligations or run out of money. However, this does not mean that there are no risks to your finances, the U.S. dollar, and the economy. There are. As mentioned, the Fed can create money at will, so it will be able to pay its obligations in dollars. However, this creates new dollars. Importantly, this dynamic limits the Fed’s ability to tighten monetary policy and meet its obligations. Additionally, the Fed is losing money, which reduces its remittances to the U.S. Treasury. This means that either the deficit will grow, government spending will need to decrease, or tax revenues must increase. Each of these outcomes is painful. This article discusses the implications of Fed losses and the risks to keep an eye out for.

Understanding the Federal Reserve’s Balance Sheet

Understanding the Federal Reserve’s balance sheet is key to understanding the impact of Fed losses. Every effort will be made to make it easy to follow along. As well as, provide you with additional tools to understand and monitor the situation. Ultimately, you will leave with a level of understanding of the situation and risks that most people are not armed with.

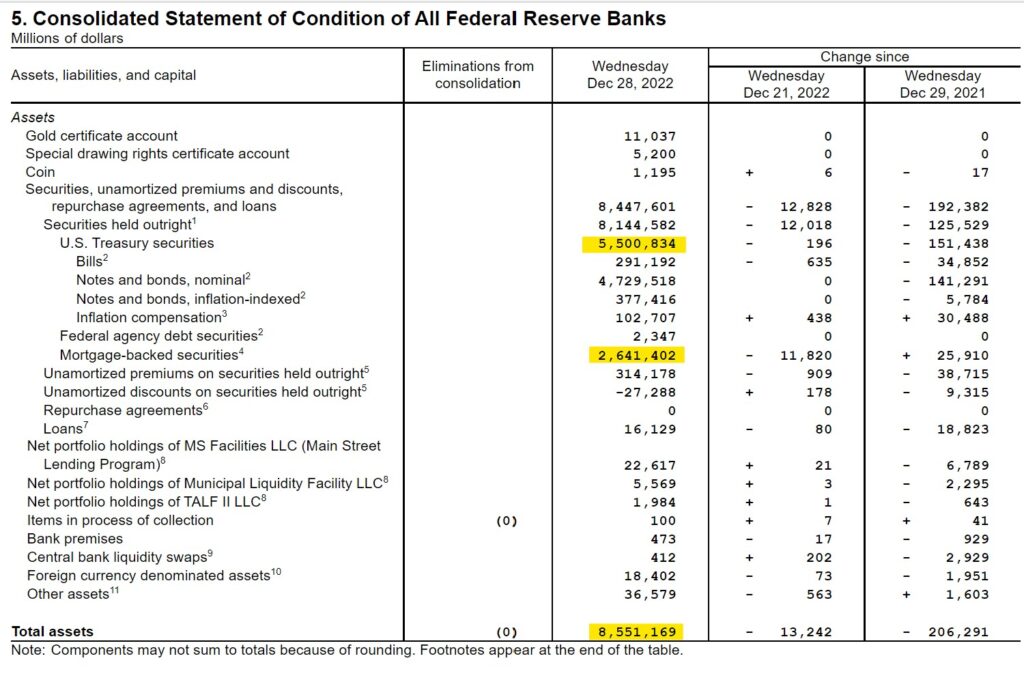

Federal Reserve Balance Sheet – Assets

Above is the section of the Federal Reserve’s balance sheet showing their assets. While there are a number of assets listed, U.S. treasuries and mortgage-backed securities make up most of the Fed’s assets. Slightly more than 95% of the total. The rest of the assets are only a small percentage of the balance sheet. So, understanding the high level view of the asset portion of the Federal Reserve’s balance sheet is relatively simple. These are both marketable securities that the Fed can sell and from which the Fed earns interest payments.

More Tools to Understand Why the Fed is Losing Money:

Our Fed Losses Dashboard tracks and reports upon Fed losses as they occur. For a broader perspective, the Federal Reserve Dashboard tracks the overall status of the Federal Reserve's balance sheet and discusses the impacts of changes. Federal Reserve Balance Sheet – Liabilities

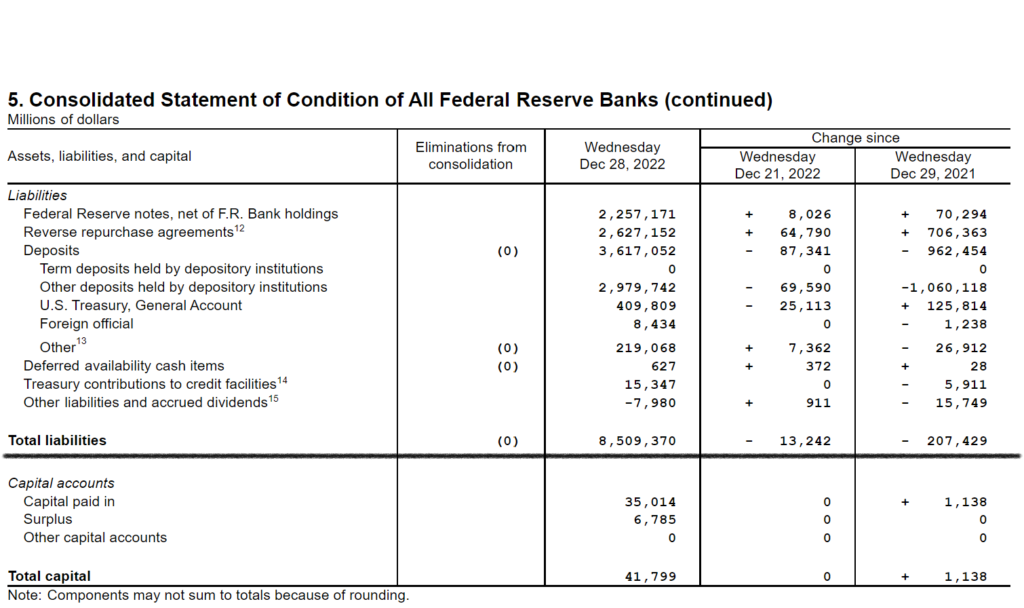

Most of the Federal Reserve’s liabilities are relatively easy to understand as well. However, there are some special considerations when discussing the impact of Fed losses. First, let’s discuss deposits. Currently, deposits are the largest Federal Reserve liabilities on their balance sheet. Deposits are money that the Fed holds from banks and government entities. The banking institution or government has a claim to this money, so it is a liability to the Fed. Banks account for most of the deposits, but some are from the U.S. government. Yet more deposits come from foreign entities. The Fed pays interest on most of these deposits.

Second, is the reverse repurchase agreements. Reverse Repo agreements are essentially the opposite of a Repo agreement. Repo agreements involve the borrower selling collateral, usually treasuries, and agreeing to purchase them back later. Usually short-term, such as the following day. The seller agrees to purchase the collateral back at a later date at a higher price than they sold them. Effectively, they borrow money and pay interest and the loan is secured by the collateral involved. In the case of reverse repurchase agreements, it is the Fed that owes the money and pays the interest. Reverse repurchase agreements are available to banks and certain money market funds.

Why the Fed is Losing Money

The Fed earns interest on Treasury securities and mortgage-backed securities. Most of these investments were bought when rates were lower. Whereas interest rates change almost immediately on deposits and mortgage-backed securities, which the Fed pays interest on. As a result, the Fed is currently paying out more in interest than it is receiving in interest payments. This results in the Fed losing money on the net interest income.

Federal Reserve Liability Accounts that Require Special Discussion

Understanding “Federal Reserve notes, net” is relatively easy in one respect. It is just a fancy way of saying cash or dollar bills. Once it is clear that this is just cash, it sounds simple. Ironically, this is actually one of the more interesting liability accounts for our discussion. Here is why. Traditionally, cash issued by the Federal Reserve has been backed by at least as much value in assets held by the Federal Reserve. Here is how they explain it:

Federal Reserve Accounting for Currency and Coin

Federal Reserve notes are liabilities on the Federal Reserve’s balance sheet. The asset counterpart to these liabilities is typically U.S. Treasury securities, mortgage-backed securities, and other assets. The Federal Reserve receives interest earnings from the assets that collateralize Federal Reserve notes. The income of the Federal Reserve System is derived primarily from the interest on U.S. government securities that it has acquired through open market operations. After it pays its expenses, the Federal Reserve turns the rest of its earnings over to the U.S. Treasury.

source

So, the dollar will not be fully backed by Federal Reserve assets once Federal Reserve losses exceed its surplus capital. There is an accounting plot twist here though. When a business or company incurs losses, that reduces its equity. When the Federal Reserve incurs losses, they turn into an asset.

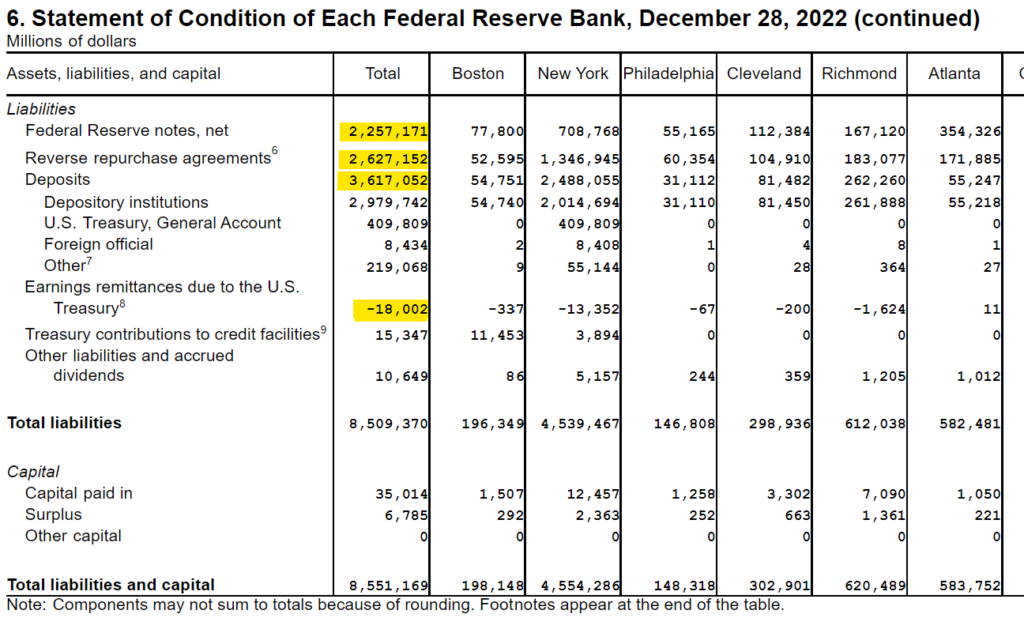

Fed Losing Money – Weird Liability Account is Negative

This accounting treatment mentioned above is unique to the Federal Reserve. And it occurs in the account called earning remittances due to the U.S. Treasury. Its value is now negative! Indicating the amount of losses that the Federal Reserve has sustained to this point in time. So, there is now an asset on the Federal Reserve’s balance sheet of a little more than $18 billion that they “earned” by losing money. It is a valid asset in the respect that they get to defer remitting earnings to the U.S. Treasury until they have recouped this amount.

Because of this rather unusual accounting method and the ability to create more dollars at will, there is no reason to believe that the Federal Reserve will ever become insolvent or declare bankruptcy. They can always create more money and they have an accounting method that deals with losses in a manner so as to create an asset.

This deferred asset is an asset in the sense that it provides relief from paying a future amount until ‘extinguished’. However, it is not an asset in the sense that it can be exchanged for anything else of value. It only serves to delay when the Federal Reserve starts remitting earnings to the Treasury again.

Federal Reserve Balance Sheet – Capital Account (Equity)

To complete the relevant understanding of the Federal Reserve’s balance sheet, one must examine the Fed’s capital accounts as well. Those are the accounts below the black line in the image above. There are two accounts with balances, Capital paid in and Surplus. The capital paid in account is money that member banks have paid in to the Fed. The amount is based upon the capital positions of member banks. Here is a more complete explanation of the Fed’s paid in capital account.

The important point for this discussion is that the capital paid in account adjusts. Per law, it adjusts up and down based upon the number of member banks’ and their levels of capital. The Fed legally must return a portion of the capital paid in, back to banks when their capital decreases.

Now the surplus account. This account is analogous to retained earnings. Essentially, it is the money that the Fed has earned in the past and not paid out to banks as dividends or remitted to the U.S. Treasury. This account represents how much the Federal Reserve could lose without having a negative capital position (excluding the member banks’ portion). In other words, the amount that it could lose without owing more than it owns.

From this the deferred asset account that was “earned” from the Fed losses also needs to be backed out. This is because it is not a marketable asset. Since it is not marketable, it is unable to serve to back the dollar. Nor is it useful for tightening monetary conditions. If the surplus account + earning remittances due to the treasury is less than zero, then the dollar is not fully backed by marketable assets.

Where is the Risk from Fed Losses?

So, with this understanding of the Federal Reserve’s balance sheet, it is clear that these losses will not bankrupt or cause the Federal Reserve to become insolvent. Now we can examine what is at risk.

The risk is to the U.S. dollar itself via a three-pronged threat:

- The degree of confidence in the dollar plays a role in its value. Given that the ability of the Fed to back the dollar with marketable securities has declined, confidence and value may decline as well. This is unlikely to affect domestic use by any significant amount in the near-term. However, it is reasonable to assume that large foreign holders will take note and may begin shunning the dollar. Selling assets and buying back a currency can keep its value propped up. The ability for the Fed to perform this function decreases as their ratio of marketable assets to dollars declines.

- Creating new money to cover these losses runs counter to the Fed’s ability to tighten. Creating new money runs directly counter to tightening the money supply.

- Federal Reserve losses decrease funding to the Federal Government. The Federal Reserve remits profits to the treasury. Without these funds, the government would most likely run a greater deficit and issue more debt. This leads to a weaker financial position for the Federal Government. Which in turn may lead to additional money being created if the Fed has to step in to buy the treasuries to fund the government.

To stay informed about the current economic situation and be prepared as well as possible, subscribe to our newsletter. How Much Does the Federal Reserve Earn?

For fiscal year 2022, the Federal Reserve provided in excess of $106 billion to the U.S. Treasury. The prior year they contributed in excess of $100 billion(1). While this does not make up the bulk of the federal government’s receipts, it is significantly larger than some other sources of funds. For example, in fiscal year 2022, estate and gift taxes only contributed $33 billion(2).

So, the risk of the Fed’s bankruptcy is essentially non-existent. In contrast, the risks to the U.S. dollar are real.

Fed Losses in Summary

Fed losses should not cause any immediate failure within the economy. However, the fact that the Fed is losing money is not without consequences. Federal Reserve losses contribute to the three consequences outlined earlier. Those three dynamics are some of several factors that directly undermine how much the Fed can tighten monetary policy. This in turn limits the Fed’s ability to fight inflation. This raises the risk of long-term excessive inflation or a full blown currency crisis.

Additionally, Fed remittances to the treasury have subsided. Remittances will not resume again until they earn enough money to extinguish the deferred asset. This means that the Federal Government will have an additional budgetary gap. Leading most likely to greater deficit spending, greater debt, and larger interest payments. This dynamic also raises the risk of higher inflation and potentially a currency crisis. Additionally, the lack of Fed remittances increases financial strain on the Federal Government’s finances.

How to Deal with the Fed Losing Money during Inflation

Remedying this issue now is tricky. To reduce the Federal Reserve losses, the Fed needs to lower interest rates. However, it is trying to fight the inflation that resulted largely from dramatically increasing the money supply in response to the coronavirus lockdowns. And to fight this inflation, it has been raising interest rates. In essence, this has created a dynamic of the Fed vs. the Fed. The Fed is raising interest rates to fight inflation, but those rate increases amplify Fed losses. This in turn reduces its ability to fight inflation over the long-run.

Perhaps they should just pause. The Fed clearly overstimulated the economy earlier, causing the current inflation. Now they have tightened to the point that a recession appears quite likely. Over the last few months, inflation has partially subsided by some metrics. Yet it remains elevated well beyond historical levels.

If the Fed pivots and lowers interest rates, inflation will almost certainly come roaring back, causing yet more pain. Yet if they continue to raise rates, the likelihood and severity of recession will only increase. They haven’t guessed well lately, maybe it is time for a break. It’s time to see what the market would do without their ‘adjustments’.

More Related to Fed Losses:

| Learn more about the limits on the Fed’s ability to tighten | Better understand what drives inflation | More peculiar Fed policy | Find out if the Fed knows or is just guessing |

| How Much Can The Fed Tighten | Money Supply and Inflation Dashboard | Reserve Requirements Abolished | Weird Fed policy, they can’t explain |