A Brief History and Why to Know What an Ample Reserve Regime is:

The Federal Reserve abolished the reserve requirements for banks operating in the United States. Reserve Requirement Abolished! What Is the Fed Doing Now? covers this change more thoroughly. This change brought a new method to regulating banks. The Fed calls it an Ample Reserve Regime. But what is it and could it be dangerous? The Federal Reserve released a memo on March 15, 2020 stating:

For many years, reserve requirements played a central role in the implementation of monetary policy by creating a stable demand for reserves. In January 2019, the FOMC announced its intention to implement monetary policy in an ample reserves regime. Reserve requirements do not play a significant role in this operating framework.

In light of the shift to an ample reserves regime, the Board has reduced reserve requirement ratios to zero percent effective on March 26, the beginning of the next reserve maintenance period. This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses.

Federal Reserve

Why Did the Fed Change From a Reserve Requirement to Ample Reserve Regime?

The abolition of the reserve requirements is a major structural change to the United States banking system. Therefore, understanding what an Ample Reserve Regime and how it structurally changes the banking system is critical.

Analysis of a number of excerpts from Chairman Powell’s speech will aid in unlocking what an Ample Reserve Regime is. One would hope that it would also explain the reasoning why significantly restructuring the U.S. banking system is desirable.

The Committee made the fundamental decision today to continue indefinitely using our current operating procedure for implementing monetary policy. That is, we will continue to use our administered rates to control the policy rate with an ample supply of reserves so that active management of reserves is not required. This is often called a “floor system” or an “abundant reserves system.” Under the current set of operating procedures, as outlined in the implementation note released today, this means that the federal funds rate, our active policy tool, is held within its target range by appropriately setting the Federal Reserve’s administered rates of interest on reserves, as well as the offer rate on the overnight reverse repo facility, without managing the supply of reserves actively. As the minutes of our recent discussions have indicated, the FOMC strongly believes that this approach provides good control of short-term money market rates in a variety of market conditions and effective transmission of those rates to broader financial conditions.

Federal Reserve

This segment hints that there is no intent to return to reserve requirements. They further state that they will administer the rates for repos and reserves to ensure an ample supply of reserves. Balancing the simultaneous challenges of using interest rates to manage the banking system’s reserves and as a tool of monetary policy will likely prove difficult. It is conceivable that the Fed could preserve significant reserves within the banking system through administration of rates. However, the chances of ensuring that all 4000+ banks maintain sufficient reserves by this method seems remote. Different business practices and economic conditions exist. So, assuming all banks will respond similarly to interest rates is likely folly.

Different banks will respond in different ways to any given interest rate policy. Similarly, prudent monetary policy may dictate tightening at a point in time when banks require more reserves. Such an event would result in a direct conflict between the Ample Reserve Regime and prudent monetary policy.

The Fed does explain (to some degree) what they are doing. As far as benefits of the Ample Reserve Regime system, they state, “this approach provides good control of short-term money market rates in a variety of market conditions and effective transmission of those rates to broader financial conditions.” However, the Fed already has control of the rates that they offer on deposits and the repo rates. So, there is no new or added benefit. There is no reason to believe that their interest rate controls would lose effectiveness while reserve requirements are in place. They have had control of these rates and the reserve requirement for many decades already.

Settling this central question clears the way for the FOMC to address a number of further questions regarding the remaining stages of balance sheet normalization. The decision to retain our current operating procedure means that, after allowing for currency in circulation, the ultimate size of our balance sheet will be driven principally by financial institutions’ demand for reserves, plus a buffer so that fluctuations in reserve demand do not require us to make frequent sizable market interventions. Estimates of the level of reserve demand are quite uncertain, but we know that this demand in the post-crisis environment is far larger than before. Higher reserve holdings are an important part of the stronger liquidity position that financial institutions must now hold. Moreover, based on surveys and market intelligence, current estimates of reserve demand are considerably higher than estimates of a year or so ago. The implication is that the normalization of the size of the portfolio will be completed sooner, and with a larger balance sheet, than in previous estimates.

Federal Reserve

On a New Path – No Intent to Reinstate the Reserve Requirement:

This statement makes it clear that the Fed was abandoning or moving towards abandoning the process of reducing its balance sheet. Additionally, the banking industry’s demand for reserves constrains the Fed’s ability to reduce its balance sheet in the future. In essence, they will prioritize providing liquidity to the banking sector over the ability to tighten. This set of conflicting goals limits the Fed’s ability to tighten monetary policy.

This revised operational mode runs counter to the need to fight inflation. The current market reality of an inflationary environment highlights the risk of this strategy. One can hope the Fed crushes inflation prior to the banking system needing reserve supplementation. Yet, the timing of such events is uncertain. Even if it works out this time, the risk of needing to expand the monetary supply to stabilize the banking system remains. This would impair the ability of the Federal Reserve to fight inflation. The stakes are high if the banking sector requests reserves at a time when inflation is elevated. The Fed will need to pivot to monetary easing to satisfy the banking sector, which would stoke inflationary pressures again.

In addition to Powell’s prepared statement, some of the questions and answers that followed give some additional insights:

JEAN YUNG. Hi, I’m Jean Yung with Market News. I have a question about the ultimate size of the balance sheet. How will the Fed judge what is a reasonable level for financial institutions’ demand for reserves when it appears to be rising at a fast pace over the past year and perhaps at a faster pace than can be explained by regulatory changes during that same time frame? Would you prefer to err on the side of being more generous, or would you try to encourage banks from holding—to hold less reserves?

CHAIRMAN POWELL. Let me be clear. I don’t know that demand for reserves has risen over the past years. I think our understanding of demand for reserves—remember that the banks have more reserves than they need. Reserves are still quite abundant. So the question is, how much of that amount is actually going to be needed in the end after, you know, after the firms adjust to our very gradual decrease? And so our understanding, really, of the distribution of reserves and how much will be needed has moved up over the past year. And then there would be a buffer on top of that. And then we would want to be—we would want to have a buffer, as I mentioned in my remarks, because we want to be operating in an abundant reserves regime where we operate through our administered rates.

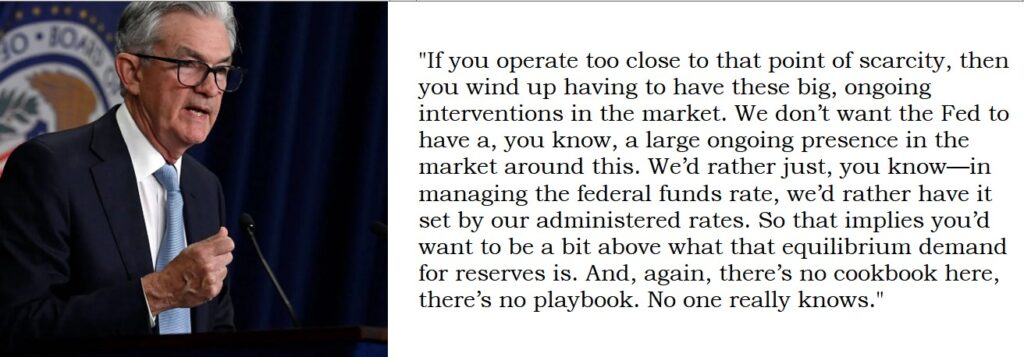

If you operate too close to that point of scarcity, then you wind up having to have these big, ongoing interventions in the market. We don’t want the Fed to have a, you know, a large ongoing presence in the market around this. We’d rather just, you know—in managing the federal funds rate, we’d rather have it set by our administered rates. So that implies you’d want to be a bit above what that equilibrium demand for reserves is. And, again, there’s no cookbook here, there’s no playbook. No one really knows. The only way you can figure it out is by surveying people and market intelligence and then, ultimately, by approaching that point quite carefully.

JEAN YUNG. But do you take the survey results as given, or do you try to encourage banks from holding a [inaudible]? CHAIRMAN POWELL. We don’t take—you know, we don’t think we have a precise understanding of this at all. I want to be clear about that. These estimates are fairly uncertain.

Federal Reserve

Insights From the Fed’s Discussion of the Ample Reserve Regime:

There are some interesting points to note in the above statement:

First, Powell’s predictions of upcoming Fed actions dramatically missed actual actions. Specifically, he said that the banking system had abundant reserves, “…remember that the banks have more reserves than they need. Reserves are still quite abundant. So the question is, how much of that amount is actually going to be needed in the end after, you know, after the firms adjust to our very gradual decrease?” Yet the repo facility and loans to financial institutions showed up within two quarters. Additionally, total Fed liabilities expanded between the end of the 1st quarter 2019 (when this statement was made) and the 4th quarter 2019. This was prior to the economic influence of the coronavirus.

Liability expansion accelerated even more dramatically beginning in the first quarter of 2020. This portion is more likely due to the coronavirus than a misjudgment of the reserves needed. But, it does illustrate the dynamic nature of economic situations. As well as, underscores the difficulty in managing reserves across a wide range of institutions based on interest rate policy. Could the Fed miss the mark on the optimal level of banking system reserves? They missed when they projected the upcoming balance sheet un-winding. Instead, the Fed expanded the money supply with the dramatic increase in the usage of the repo facility and loans. This was done only shortly after the statement was made that reserves were rather abundant.

Secondly, the statement about scarcity is also interesting. Powell states, “If you operate too close to that point of scarcity, then you wind up having to have these big, ongoing interventions in the market.” Then goes on to state, “And, again, there’s no cookbook here, there’s no playbook. No one really knows.” Powell continues,“we don’t think that we have a precise understanding of this at all. I want to be clear about that. These estimates are fairly uncertain.”

So, if the Fed misjudges their policy, then there will be large adjustments to resupply the banks with sufficient reserves. These adjustments to supply the banking sector with additional reserves rapidly and in large quantities will create inflationary pressure. This will constrain the Fed from fighting inflation anytime when the banking sector is short on reserves. Yet, the Fed repeatedly admits that they do not have a good grasp on the quantity of reserves needed.

So, the Fed is determined to manage reserves using an abundant reserve regime policy. But, they do not have a good understanding of how to ensure that ample reserves within the banking sector. Nor how to measure the amount of reserves that would constitute ample reserves.

Additional Concerns From Transitioning to an Ample Reserve Regime:

In addition to the above items, there is another concern that requires mention as well. The Fed made themselves individually responsible for bank reserves by operating via an Ample Reserve Regime. In the past, all banks were responsible for maintaining their own adequate reserves.

This introduces a single point of failure for the entire banking system. The Fed may have the manpower and savvy to determine the appropriate system wide reserve capacity. But, it is unlikely that they can seamlessly manage reserves at each of more than four thousand financial institutions. Especially with the blunt tool of interest rates. Interest rates do not give the Fed the ability to address any individual institution’s reserves directly. They could influence reserves across the system in general, but individual institutions will act differently. It is possible that some (or many) of them could have sub-adequate reserves despite strong overall industry reserve balances.

In addition to these administrative complications, this program introduces a moral hazard risk to the banking system. It encourages banks to lend more liberally and retain fewer liquid reserves since the Fed is taking on the management of reserves. This is poor policy. Banks can reasonably interpret the Fed’s statements to indicate essentially that the Fed will provide reserves upon demand. Powell’s comments seem to support this notion with the frequent mentions of ‘demand for reserves’. As well as the comments indicating the Fed’s goal is to meet and buffer this demand. These are easily interpreted to mean that the Fed will provide more reserves to banks, upon request.

Under this interpretation, the banks’ incentives to generate additional interest revenue via loans or investments could easily overshadow prudent management of bank reserves. This naturally leads to less stable bank balance sheets and lower underwriting requirements. And therefore, greater systemic risk in both the banking sector and the overall economy.

Conclusion:

Reserve requirements placed on banks by the Federal Reserve have been set to zero Reserve Requirement Abolished! What Is the Fed Doing Now?. As a result, the banking system has transitioned from a fractional reserve banking system to one in which there are no required reserves whatsoever.

The Fed has opted to attempt to maintain what it is referring to as an Ample Reserve Regime. In essence, this new framework requires that the Fed will maintain the appropriate level of banking reserves through administration of their interest rates. This poses several major technical challenges. First, the interest rates to maintain ample reserves could run counter to the interest rates needed to administer monetary policy. Secondly, the Fed openly admits that they are not able to accurately determine what amount of reserves are needed. Additionally, if the Fed supplies too few reserves, there will need to be, “big, ongoing interventions in the market.”

It is impossible to manage individual bank’s reserves via interest rates policy alone. Eliminating bank oversight via reserve requirements creates an environment where individual banks are far more likely to become financially unstable. This is an unnecessary risk.

The Ample Reserve Regime offers no clear benefit to the public. Additionally, because of it, risks to both bank stability and effective monetary policy increase dramatically. Far more careful consideration than demonstrated by Powell’s explanation is necessary before such major policy changes. The implementation of an Ample Reserve Regime and the removal of bank reserve requirements entail many risks. The potential costs are incredibly high to embark on such an experiment without sound reasoning.

- Learn more about the Fed’s odd policies and their implications: The Fed is Losing Money.

- Keep up with the Banking Industry News as it breaks.